Trade with Exness

Trade global markets with tight spreads, free education, and insights from experts.

Exness Withdrawal

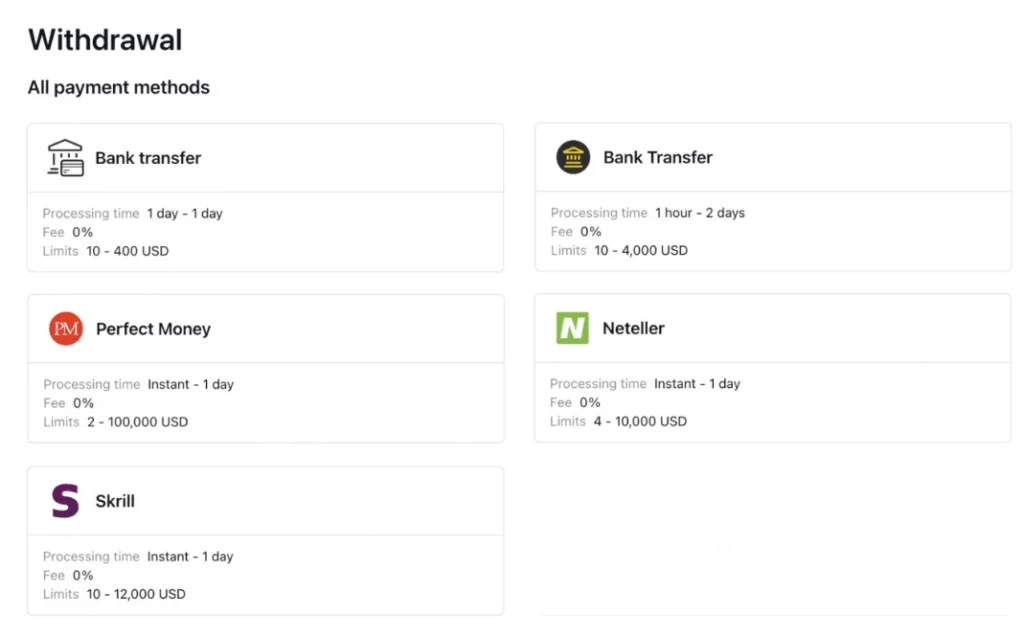

Exness Withdrawals cater to the diverse needs of its global users by offering multiple withdrawal methods, including bank transfers, e-wallets, and credit cards. This flexibility allows traders to choose the most convenient option based on their location and preferences.

Exness also emphasizes transparent fees and quick processing times, aiming to minimize waiting periods and reduce costs associated with withdrawals. These features, coupled with robust security measures, give traders peace of mind, ensuring that their financial transactions are handled with care and efficiency. This reinforces Exness’s reputation as a reliable broker in the competitive online trading world.

Types of Withdrawals Offered by Exness

Exness prioritizes customer satisfaction, particularly with fund withdrawals, offering diverse options to meet global clients’ preferences. With a focus on accessibility and efficiency, Exness provides various withdrawal methods designed for easy and swift fund access. Here’s a summary of Exness’s withdrawal options:

Bank Wire Transfer: A traditional method that allows traders to transfer their earnings directly to their bank account. While secure and widely accepted, bank wire transfers may take several business days to process, depending on the banks involved and their respective countries.

Credit and Debit Cards: Exness supports withdrawals to major credit and debit cards, including Visa and MasterCard. This method is preferred by many traders for its convenience and relatively fast processing times, typically within a few business days.

E-Wallets: Reflecting modern preferences for digital transactions, Exness offers withdrawals through various e-wallets such as Neteller, Skrill, and WebMoney. E-wallet withdrawals are generally faster than traditional methods, often processed within 24 hours, providing a quick way for traders to access their funds.

Local Payment Methods: Understanding the need for localized services, Exness provides withdrawal options through local banks and payment systems in specific countries. This method ensures that traders in these regions have a convenient and cost-effective way to withdraw their funds, adhering to local banking practices and currencies.

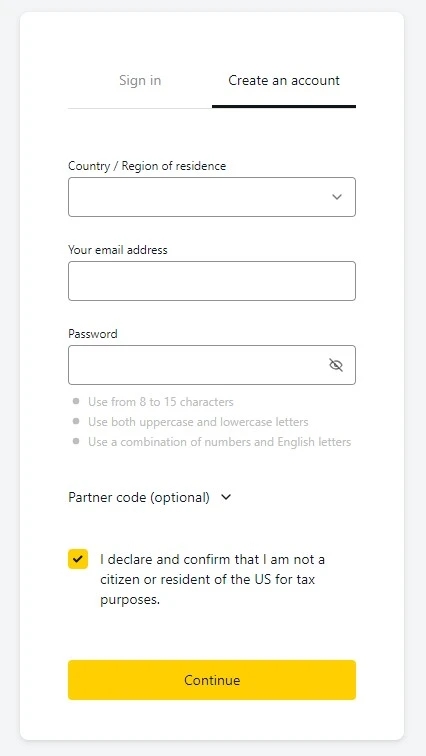

How to Make Withdraw Funds from Exness

Withdrawing funds from Exness is designed to be a straightforward process, ensuring that traders can easily access their earnings. Here’s a step-by-step guide on how to withdraw funds from your Exness account:

Step 1: Log In to Your Account

- Begin by logging into your Exness Personal Area. This is the dashboard where you manage your accounts and financial transactions.

Step 2: Select the Withdrawal Option

- Once logged in, navigate to the “Withdraw” section. Here, you’ll see various withdrawal methods available to you, including bank transfer, e-wallets, credit/debit cards, depending on your region.

Step 3: Choose Your Withdrawal Method

- Select the withdrawal method that suits you best. Keep in mind the processing times, potential fees, and convenience of each method. It’s important to choose a method that you have previously used for deposits, as Exness typically requires withdrawals to be made through the same method as the deposit to ensure security and anti-money laundering compliance.

Step 4: Enter the Withdrawal Amount

- Specify the amount you wish to withdraw. Ensure that you have sufficient free margin in your trading account to cover the withdrawal amount. It’s also a good time to double-check for any withdrawal fees or conversion rates that might apply.

Step 5: Confirm Your Withdrawal Details

- You may be prompted to confirm your withdrawal details, such as your bank account information or e-wallet address. It’s crucial to double-check these details to avoid any delays or issues with your withdrawal.

Step 6: Submit Your Withdrawal Request

- After verifying all the information, submit your withdrawal request. You will receive a confirmation from Exness, and the request will be processed according to the method’s specific processing time.

Step 7: Check Your Email for Notifications

- Exness will send you email notifications about the status of your withdrawal request. Keep an eye on your email inbox for any updates or further instructions.

Withdrawal Times at Exness

Withdrawal times at Exness vary depending on the chosen method and account verification status. Generally, withdrawals through electronic payment systems like Skrill or Neteller are processed swiftly within 1 business day, while bank transfers may take 3 to 5 business days to reflect in the recipient’s account due to bank processing times. However, the speed of withdrawal processing may also be influenced by factors such as account verification procedures and peak trading times. Exness aims to process withdrawals promptly, but external factors like bank processing times and network congestion can affect the overall time frame.

Limits and Fees for Exness Withdrawals

Exness imposes minimal fees for withdrawals, and these may vary depending on the payment method used. Generally, electronic payment systems like Skrill or Neteller may involve nominal fees, typically ranging from 1% to 3% of the withdrawn amount. However, bank transfers often come with higher fees due to intermediary banks’ charges and currency conversion costs. Additionally, it’s essential to consider withdrawal limits, which may differ based on your account type and chosen payment method. While Exness doesn’t typically impose strict withdrawal limits, individual payment processors or banks may have their own restrictions.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Problems and Solutions with Exness Withdrawals

Although all Live account options are also available for demo accounts, it should be remembered that simulation trading cannot replace real market conditions. One such difference between actual trading and trading on a demo account is the fact that the volumes of positions opened on a demo account are not released to the market and do not affect it. On a real narrative, the trading volumes are released to the market and affect it, especially large positions in terms of volume. The speed of execution on real trading accounts in Exness is the same as on demo accounts.

Below are typical challenges traders might encounter with Exness withdrawals, along with effective solutions to enhance their experience.

| Problem | Solution |

| Delays in Processing Withdrawals | Stay informed about Exness’ withdrawal policies and processing times. |

| Unexpected Fees Incurred during Withdrawal Transactions | Choose withdrawal methods with lower fees and faster processing times. |

| Limitations Imposed by Payment Methods or Account Verification Requirements | Ensure account verification is complete to avoid potential delays. |

| Funds Not Reflecting in Account After Withdrawal | Check the status of the withdrawal transaction on the Exness platform. Ensure the correct withdrawal details were provided to avoid processing errors. |

| Incompatibility Issues with Withdrawal Method | Verify that the chosen withdrawal method is supported by Exness. |

For any unresolved issues or additional assistance, contact Exness customer support. They can provide personalized guidance and resolve specific withdrawal-related concerns.

Benefits of Exness Withdrawal

Exness optimizes withdrawal for speed, efficiency, and user-friendliness, providing benefits that enhance clients’ trading experience. These benefits prioritize convenience, security, and flexibility, simplifying fund management. Here are Exness’s key withdrawal advantages:

- Instant Withdrawals: Exness provides instant withdrawals, allowing traders immediate access to their funds, which is particularly advantageous in time-sensitive situations.

- No Withdrawal Fees: There are no withdrawal fees with Exness, ensuring traders receive the full requested amount without any deductions.

- Wide Range of Withdrawal Methods: Similar to its deposit options, Exness offers various withdrawal methods such as bank wire transfers, credit/debit cards, and e-wallets like Neteller, Skrill, and WebMoney.

- High Level of Security: The withdrawal process includes advanced security measures such as SSL encryption to protect traders’ financial information and prevent unauthorized access.

- Flexible Withdrawal Amounts: Exness accommodates withdrawals of various sizes, catering to both small-scale and large-scale traders.

- Rapid Processing Times: Withdrawal requests are processed quickly, minimizing wait times and ensuring efficient fund management for Exness clients.

- Multiple Currency Options: Traders have the flexibility to withdraw funds in various currencies, potentially reducing the need for currency conversion and associated costs.

Conclusion

Exness’s withdrawal process is a standout feature in online forex and CFD trading, showcasing the broker’s commitment to a seamless trading experience and easy access to funds. Offering diverse withdrawal methods like bank transfers, credit/debit cards, e-wallets, and local options, Exness meets the varied preferences of its global users. This flexibility, paired with transparent fees, quick processing, and strong security, ensures traders can confidently and conveniently withdraw earnings. The straightforward procedure underscores Exness’s dedication to customer satisfaction and transparency, supported by comprehensive customer service for traders of all levels. This approach fosters trust and reliability, solidifying Exness’s position as a leading broker committed to client financial well-being.

FAQ for Exness Withdrawal

What withdrawal methods are available at Exness?

Exness offers a variety of withdrawal methods, including bank wire transfers, credit/debit cards, e-wallets like Neteller, Skrill, and WebMoney, and local payment options specific to certain regions. The availability of these methods may vary depending on your location.

How long does it take to process a withdrawal?

The processing time for withdrawals at Exness varies by the method chosen. E-wallet withdrawals are often processed within 24 hours, while bank transfers and credit/debit card withdrawals may take several business days.

Are there any fees for withdrawing funds?

Exness strives to offer fee-free withdrawals for most methods. However, some payment service providers might impose their own fees. It’s advisable to check the specific conditions for your chosen withdrawal method and consult with your payment provider about any fees that may apply.

Can I withdraw funds if I have open positions?

Yes, you can withdraw funds from your Exness account even if you have open positions, as long as you maintain the necessary margin levels for those positions. Ensure that the withdrawal amount does not affect your open positions adversely, leading to stop-outs or margin calls.

How can I cancel a withdrawal request?

Withdrawal requests can usually be canceled if they have not been processed yet. You can do this from your Personal Area by selecting the withdrawal request and opting to cancel it. If the request has already been processed, cancellation will not be possible.

Refer a friend to earn 50$ each.