Trade with Exness

Trade global markets with tight spreads, free education, and insights from experts.

Exness Minimum Deposit

Exness offers a minimum deposit starting from $1, varying depending on the account type, region, and chosen payment method. This flexibility ensures accessibility and accommodates the diverse needs of traders on the platform, allowing for a seamless start to their trading journey.

Exness distinguishes itself by offering a variety of account types, each with its own minimum deposit criteria, tailored to suit different trading styles and objectives. This flexibility ensures that whether a trader is looking to explore the forex market with minimal risk or engage in more substantial trading activities, there is an account option suitable for them.

Exness Deposit Rates

Explore the different account types tailored to suit various trading needs, each offering distinct features such as flexible minimum deposits and varying commission structures.

Standard Account: With a minimum deposit that varies based on the chosen payment system, this account type doesn’t incur any commission charges.

Standard Cent Account: Offering flexibility with the minimum deposit determined by the payment system, traders can enjoy this account without commission fees.

Pro Account: Designed for more experienced traders, this account requires a $200 minimum deposit and is commission-free.

Zero Account: Experience low-cost trading with a $200 minimum deposit, though there is a commission starting from $0.05 each side per lot.

Raw Spread Account: For traders seeking tight spreads, this account requires a $200 minimum deposit and may have commission charges of up to $3.50 each side per lot.

Exness offers a diverse range of deposit methods to ensure traders can select an option that aligns with their preferences and geographical location. Here’s an overview of some available options:

- Perfect Money allows deposits ranging from 10 to 100,000 USD and processing speeds of up to 30 minutes.

- Skrill accepts deposits from 10 to 100,000 USD with processing times of up to 30 minutes.

- Online Bank deposits range from 15 to 1,000 USD, processed within 1 hour.

- Bank Card deposits range from 10 to 10,000 USD, processed within 30 minutes.

- Neteller accepts deposits from 10 to 50,000 USD with processing times of up to 30 minutes.

Deposit Options and Fees of Exness Broker

Exness offers a variety of deposit methods with varying fees, depending on the method chosen. Here are some common deposit methods and the associated fees that Exness may offer:

- Bank Wire Transfer: Typically, Exness may allow bank wire transfers for deposits. Fees may vary depending on your bank and location. Your bank may charge you a wire transfer fee, and Exness may also have its own fees or commissions for processing bank wire transfers.

- Credit/Debit Cards: Exness may accept deposits via major credit and debit cards such as Visa and Mastercard. Fees may apply, which could be either a fixed amount or a percentage of the transaction amount.

- Electronic Payment Systems (e-wallets): Exness may support various electronic payment systems like Skrill, Neteller, WebMoney, and others. Fees can vary depending on the specific e-wallet used and your location.

- Local Payment Methods: Depending on your region, Exness may offer local payment methods specific to your country. These could include online banking options, prepaid cards, or other localized payment solutions. Fees will vary based on the chosen method.

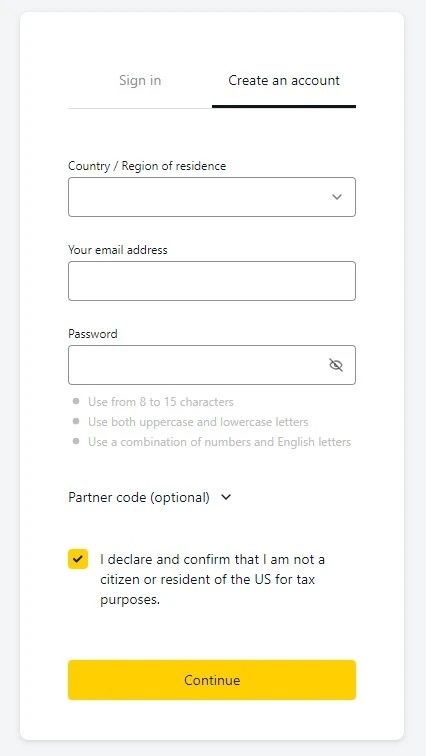

How to Make Deposit Money on Exness

To make a deposit on Exness, you typically follow these steps:

- Log in to Your Exness Account: Visit the Exness website and log in to your trading account using your username and password.

- Navigate to the Deposit Section: Once logged in, navigate to the deposit section of your account. This is usually located in the “Deposit” or “Funding” section of the platform.

- Select Deposit Method: Choose your preferred deposit method from the options provided. Exness offers various deposit methods, including bank wire transfer, credit/debit cards, electronic payment systems (e-wallets), and potentially cryptocurrencies or local payment methods depending on your region.

- Enter Deposit Amount: Enter the amount you wish to deposit into your Exness trading account. Ensure that the amount meets any minimum deposit requirements and that you are comfortable with any associated fees.

- Complete Payment Details: Depending on the chosen deposit method, you may need to provide additional payment details such as bank account information, credit/debit card details, or e-wallet login credentials.

- Confirm Deposit: Review the deposit details and confirm the transaction. Follow any additional prompts or authentication steps required by your chosen payment method.

- Wait for Processing: After confirming the deposit, you will need to wait for the transaction to be processed. Processing times can vary depending on the deposit method, but many deposits are processed promptly.

- Check Account Balance: Once the deposit is processed successfully, the funds should appear in your Exness trading account balance. You can verify the deposit by checking your account balance or transaction history.

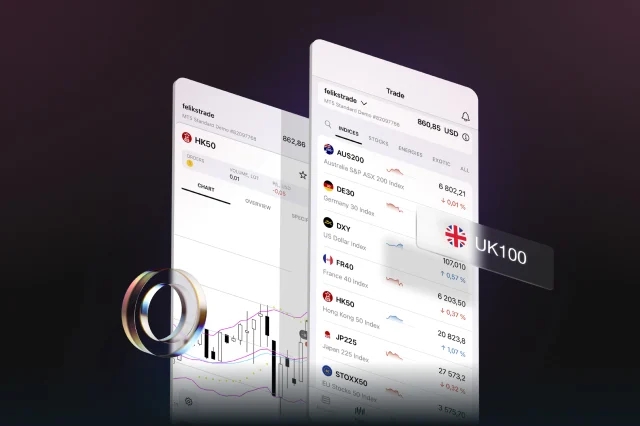

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Features of Exness Minimum Deposit

The Exness minimum deposit offers features catering to diverse traders, from beginners to experienced investors. These features enhance accessibility, flexibility, and trading efficiency, making Exness a competitive choice among online platforms. Key features include:

- Accessibility for All Levels of Traders: One of the standout features of the Exness minimum deposit is its inclusivity. By offering a low entry barrier, Exness makes it possible for beginners with limited capital to start trading.

- Variety of Account Types: Exness provides different account types, each with its own minimum deposit requirement. This variety ensures that traders can select an account that best fits their trading style, risk tolerance, and financial capability.

- Leverage Options: The minimum deposit also influences the leverage options available to traders. Higher leverage can be accessed with certain account types, providing traders with the potential to control larger positions than their initial deposit would typically allow.

- Instant Deposits and Flexible Funding Methods: Exness ensures that traders can fund their accounts easily and start trading as quickly as possible. The platform supports instant deposits through various payment methods, including bank cards, e-wallets, and bank transfers.

- No Hidden Fees on Deposits: Exness prides itself on transparency, offering a fee-free structure on deposits. Traders can fund their accounts without worrying about additional charges, ensuring that the entire amount of the minimum deposit is available for trading.

- Scalability: As traders grow more confident and wish to expand their trading activities, they can easily move to account types with higher minimum deposits but more advanced features and potentially more favorable trading conditions.

Security of Exness Deposit Funds

Exness ensures deposit security through rigorous measures, instilling confidence in traders regarding their invested capital. Here are key aspects of Exness’s deposit security:

- Regulation and Compliance: Exness is regulated by reputable authorities like CySEC and FCA, imposing stringent standards for fund protection and regulatory compliance.

- Segregation of Funds: Client funds are kept separate from corporate accounts, minimizing risk during insolvency.

- Tier-1 Banking Partners: Exness collaborates with top-tier banks, subject to strict oversight, for secure fund storage.

- Secure Payment Methods: Various secure payment options, including bank transfers and e-wallets, undergo thorough vetting to ensure transaction integrity.

- Encryption and Security Protocols: Advanced encryption, such as SSL, shields client data, reducing the risk of unauthorized access.

- Risk Management: Exness employs robust risk management practices to identify and mitigate operational, financial, and cybersecurity risks.

- Client Education and Support: Educational resources and support services empower clients to protect their accounts through measures like two-factor authentication and password security best practices.

Summary

Exness offers a minimum deposit starting from $1, varying based on account type, region, and payment method. This flexibility caters to diverse trader needs, providing a seamless start to their trading journey. Account types like Standard, Standard Cent, Pro, Zero, and Raw Spread offer tailored features such as flexible minimum deposits and varied commission structures. Traders, whether beginners or experienced, can choose an account that suits their trading style and objectives.

FAQ for Exness Minimum Deposit

What is the minimum deposit required to start trading with Exness?

The minimum deposit at Exness varies depending on the account type you choose. Each account type has been tailored to meet different trading needs and preferences, allowing traders from all backgrounds to find an option that suits them best.

Why does Exness offer different minimum deposits for different account types?

Exness provides various account types with different minimum deposits to cater to a wide range of traders, from beginners to experienced professionals. This variety ensures that everyone, regardless of their investment capacity or trading strategy, can access the markets in a way that’s most suitable for them.

Can I change my account type if I want to adjust my minimum deposit?

Yes, Exness allows you to switch between account types if your trading needs or financial situation changes. This flexibility helps you to scale your trading activities and manage your investments more effectively as your experience grows.

Are there any fees associated with making a deposit?

Exness prides itself on transparency and does not charge any fees for making deposits. This means that the full amount of your deposit can be used for trading activities.

What payment methods can I use to make a deposit?

Exness supports a wide range of payment methods, including bank cards, e-wallets, and bank transfers. The availability of specific payment options may vary depending on your country of residence.

Refer a friend to earn 50$ each.